As 2021 comes to a close, we want to make sure your business is in great shape to start the new year. You still have some time to tie loose ends, so this week and next week we are focusing on items to check off your list that will ensure you are not dealing with 2021 as you head into 2022.

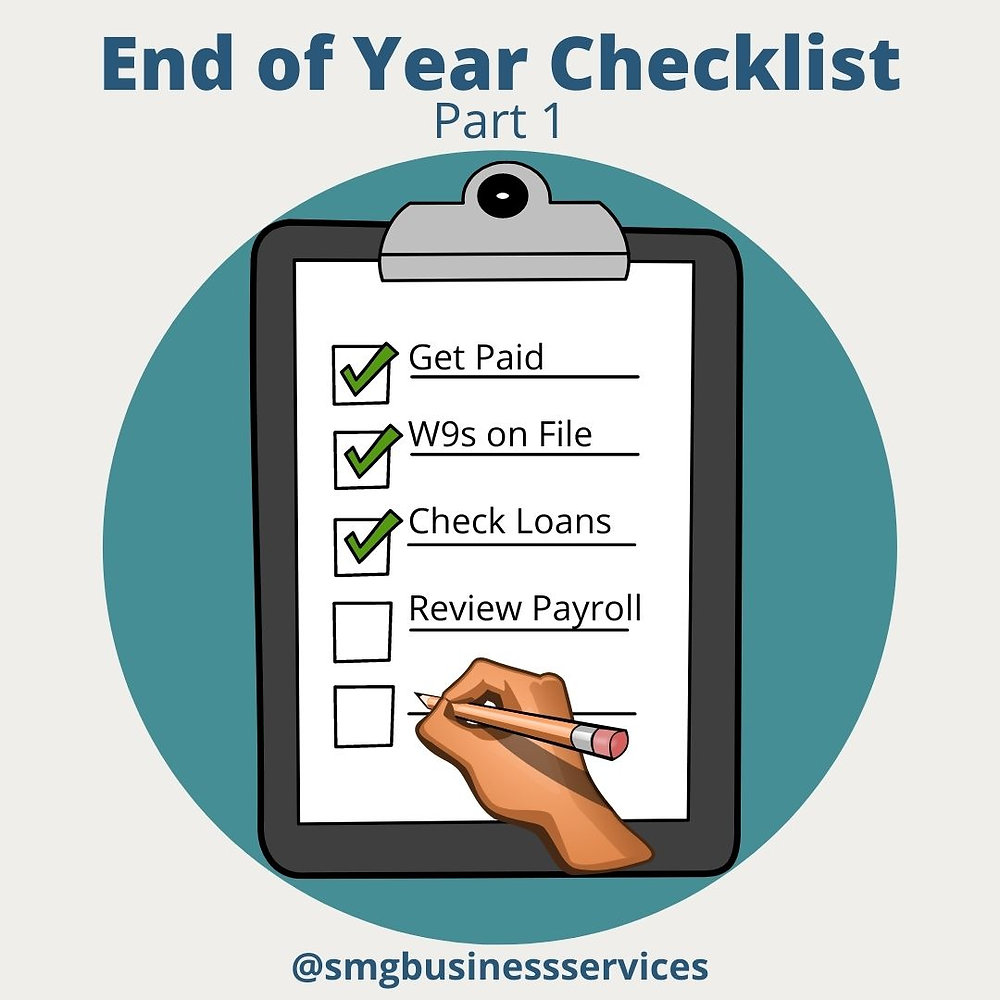

The first half of your checklist involves reviewing your payments related to contractors, vendors, lenders, and employees. Make sure the following items are up-to-date and carefully review the information you have for each individual so that you are ready for tax season.

1) Get Paid. Review Accounts Receivable and make sure you get paid before the year ends.

2) Make sure you have a W9 form on file for all independent contractors. Verify amounts paid and contact information before you create and send your 1099s.

3) Check your statements and ensure principal balance on your loan(s) is accurate.

4) Review payroll and employee information before you create and send your W2s.

We hope this list gives you some peace of mind and relieves some of the chaos that sometimes comes in December. Look for part 2 of your checklist next week! Remember to share with anyone you know that may benefit from a year-end business review.

#yearend #yearendreview #getpaid #stressfree2022 #finish2021strong